A donor has to have mental capacity to be able to appoint an attorney. If the donor has lost capacity, someone will need to go to the Court of Protection to be appointed as a deputy – see Court appointed deputy, for more details. This is a general guide to mental capacity for donors and attorneys.

A Lasting Power of Attorney the Health and Wellbeing can be given to an attorney but, the donor has to lack capacity for the attorney to be able to act. A court appointed deputy does not ordinarily act under this Lasting Power of Attorney (LPA).

A Lasting Power of Attorney for Finance and Property can be given to an attorney and they can act for you whether you have capacity or not unless you have specified that they can only act for you when you have lost capacity. If the court have appointed a deputy, the deputy will look after the donor’s finances under this LPA.

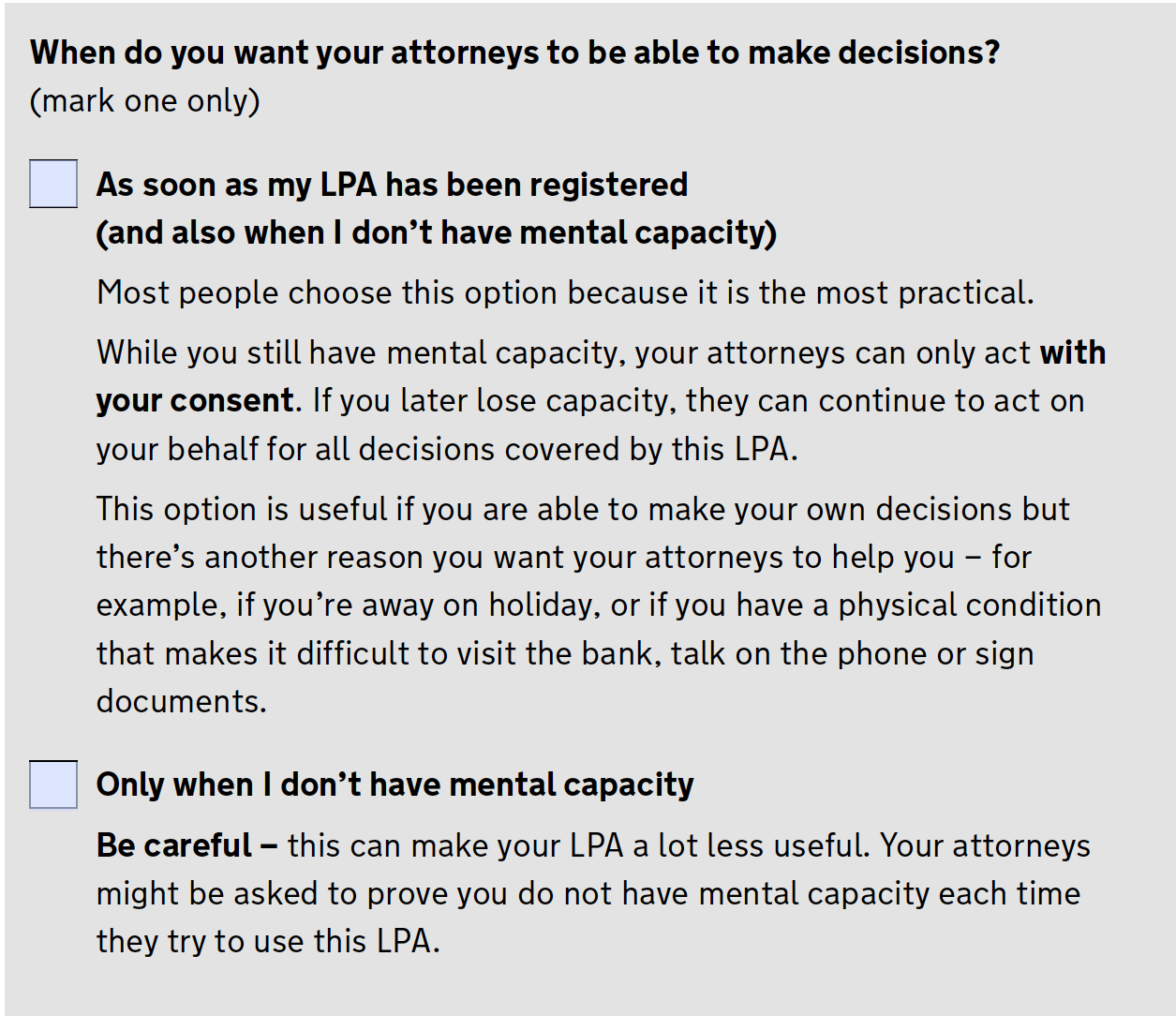

The Lasting Power of Attorney document specifically states that on page 6 – see below:

If the donor ticks the second box that the attorney can only act when the donor has lost capacity it can make the attorney’s job more difficult. So, this option should be used with caution.

The donor will need to have their capacity assessed in order for the attorney to act. The attorney will need to show both the power of attorney and the letter or assessment showing a lack of capacity.

Capacity is a complicated area and differs depending on what type of decision is being made. There is a difference between making serious financial decisions and making everyday decisions about what you are going to eat, for example. This general guide to mental capacity should help.

Checking mental capacity

Mental capacity can sometimes be permanent and sometimes it is temporary and something that someone can recover from. So, it is necessary to check that a person has mental capacity to make a decision at the time that the decision needs to be made. You will need to get a Mental Capacity Assessment (MCA) from either the donor’s doctor, social services or an indpendent body.

Mental Capacity Assessments

A mental capacity assessment will need to be carried out for specific decisions. For serious financial decisions you will need to have a full assessment done. This can be done by Social Services if you have contact with them or by and independent company. It is better to have the donor assessed by a professional who knows them but, if this is not possible, then you need to find an alternative.

If the MCA is likely to be contentious, make sure that you have a full assessment done by an approved authority. Doctors these days usually decline to carry out an assessment for finances, although they may do for health and welfare.

Mental Capacity Act and Code of Practice

Mental Capacity is governed by the Mental Capacity Act 2005 and there is a Mental Capacity Code of Practice which gives guidance for decisions made under the Act. The Code of Practice tells you what you must do when you act or make decisions on behalf of people who can’t act or make those decisions for themselves. The Code has statutory force, which means that certain categories of people have a legal duty to have regard to it when working with or caring for adults who may lack capacity. A POA should consider the Code when making decisions regarding the donor’s capacity.

Mental Capacity Act: 5 key principles

There are five key principles under the Mental Capacity Act 2005 that must be adhered to:

- A person must be assumed to have capacity unless it is established that they lack capacity

- A person is not to be treated as unable to make a decision unless all practicable steps to help them to do so have been taken without success

- A person is not to be treated as unable to make a decision merely because they make an unwise decision

- An act done, or decision made, under this Act for or on behalf of a person who lacks capacity must be done, or made, in their best interests

- Before the act is done, or the decision is made, regard must be had to whether the purpose for which it is needed can be as effectively achieved in a way that is less restrictive of the person’s rights and freedom of action

Strange decisions

Basically, the attorney must assume that the donor has capacity, unless it can be established that they lack capacity. Even if the person makes a strange decision, this does not necessarily mean that they lack capacity. It is important to take all possible steps to try and help people make a decision for themselves. If the decision does not need to be made urgently, try and wait and help the person make the decision at another time. See How to Act as an Attorney